How Do Diners Feel?: Using Industry Data and Trends to Make Decisions About Your Restaurant Operations in COVID-19

Published:

Restaurant operators have to monitor dozens of details on a day-to-day basis to keep their locations running smoothly. The COVID-19 pandemic has thrown even more elements into the mix, from coordinating off-premise dining options to ensuring the safety of staff and guests. It can be difficult to take a break to think about anything else but the daily mandatory tasks.

But staying updated on larger trends within the restaurant industry can help you anticipate and adapt for what’s next in dining during the pandemic. The American Express Insights Team looked at curated data from external sources to compile a list of trends and insights to help you make decisions for your restaurant in the coming months.

Insight #1: Consumer Sentiment Took A Hit with COVID-19 Resurgence

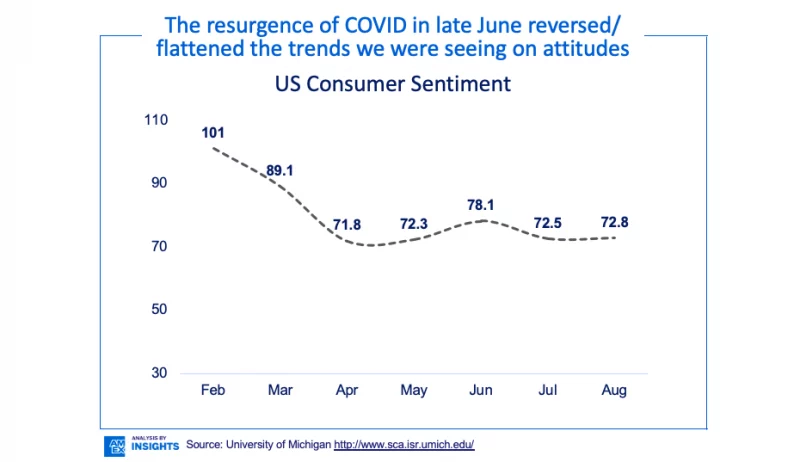

A team at the University of Michigan has been tracking consumer sentiment, a measure of feelings about the future of the economy, since the 1940s using randomized surveys of US households. As you can see in the chart above, consumer sentiment started to dive sharply beginning in March when stay-at-home orders were put in place. It bottomed out in April, and then slowly began to rise again starting in May.However, the surge of cases around the country in June and early July caused a downturn in the metric.

In the UK, surveys by data and analytics firm Growth from Knowledge on behalf of the European Commission shows consumer confidence following a similar pattern, reaching its lowest in April and then starting an upward trend in June. The metric plateaued in July and has remained at the same level in August’s results.

Australia saw a sharp decline in consumer sentiment as found by the Westpac-Melbourne Institute Index in August due to the state of Victoria’s virus resurgence and repeated lockdown.

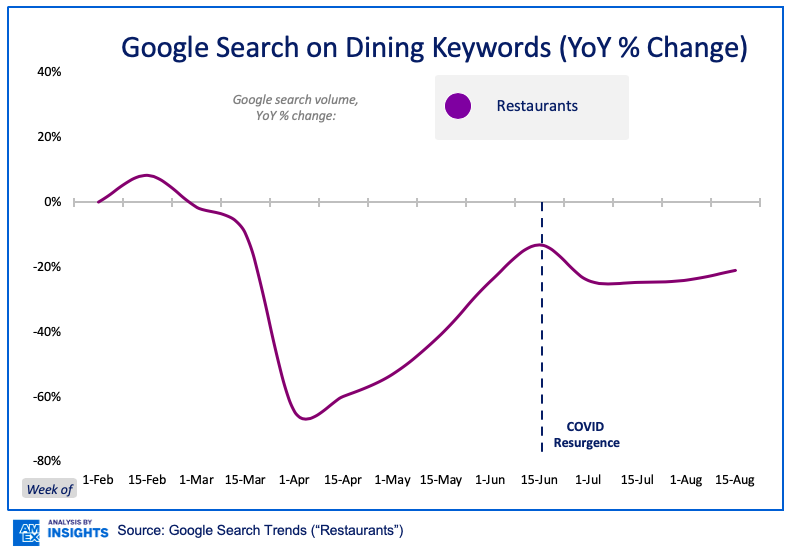

In the chart above highlighting dining keyword searches using Google Trends, you can see a similar result with Google searches for restaurants dropping to their lowest in early April, increasing steadily through mid June, and then dropping and leveling off as COVID-19 cases increased.

How Resy Helps: Fee Relief, Capacity Monitor, Restaurant Success Manager Insight

- Fee Relief: We know that the next few months will continue to be difficult for restaurants, especially because of the bumpy and uncertain road ahead. We are committed to helping our restaurant partners by offering fee relief through the end of 2020 for all of our packages. Learn more about fee relief here.

- Capacity Monitor: In order to handle changing mandates on dine-in capacity, we added a Capacity Monitor feature that allows you to enter a maximum number of people allowed in your restaurant in Resy and alerts you if you get close to that number with reservations and walk-ins. Learn more about Capacity Monitor here.

- Restaurant Success Managers: For those with Platform 360 or Full Stack packages, you have 1:1 access to your restaurant success manager who has years of experience in the industry and can consult on best practices to maximize your revenue. If you have our Platform 360 package, reach out directly to your restaurant success manager. Learn more about switching to Platform 360 here.

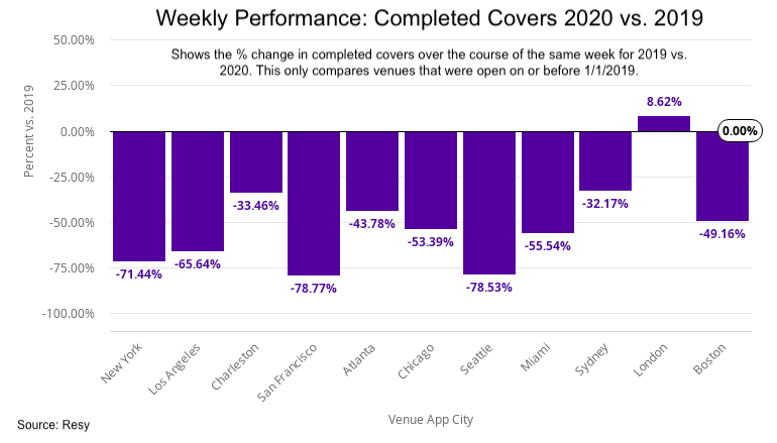

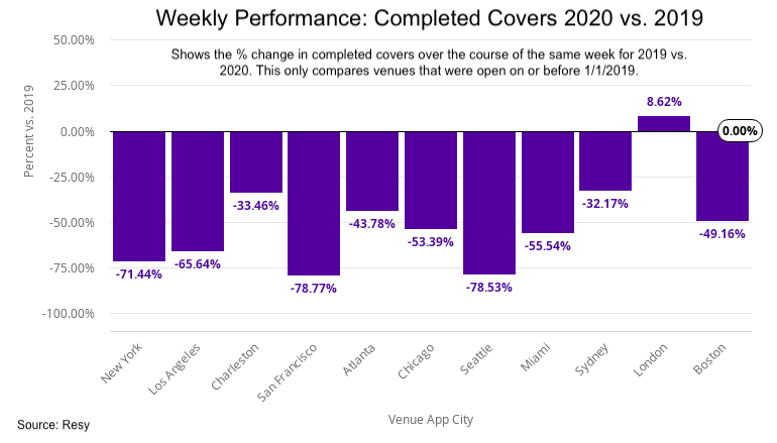

Insight 2: Restaurants Overall Are Recovering, But At Different Rates By City

Although the economic outlook is still rocky, dining is recovering faster than travel. McKinsey & Company, a global management consulting firm, has been conducting surveys and tracking credit card data every few weeks during the pandemic to monitor changes around consumer spending habits. McKinsey’s data shows that people are feeling better about returning to restaurants at a faster rate than they are about staying at hotels or taking flights.

Data gathered by our Resy Analytics team shows that 68% of restaurants on our platform are open worldwide. Taking a deeper dive into localities, you can see the huge impact of mandated dine-in restrictions and government regulations on the number of covers completed in each city. In New York, the latest data shows cover counts are 29% of what they were at the same time last year. Charleston, which has more relaxed rules around dining and venues better accommodated to outdoor space, is much higher at 67% of last year’s volume. Just this week, we saw cover volume in London surpass what it was last year at 109% of last year’s covers, largely thanks to the national Eat Out to Help Out campaign encouraging people to dine out Mondays, Tuesdays, and Wednesdays and receive a £10 discount per diner.

We’re also seeing a rise in engaged users, which are those actively booking reservations or setting Notify alerts in a given week. Our latest report shows engaged users are more than 90% of what they were pre-pandemic, meaning nearly as many diners are using Resy now as they were in early March, despite the lower number of active restaurants.

How Resy Helps: Marketing Best Practices and Access to Amex Offers

- Marketing Best Practices: Resy speaks with industry leaders to assemble resources to best market and promote your restaurant, ensuring you’re capturing the diners who are searching for restaurants in your area. Check out our articles How to Update Your Public Relations Strategy in the Face of COVID-19 and Communicating With Your Guests During the Coronavirus.

- Stand for Small: American Express has compiled a list of offers, tools, and expert advice from companies dedicated to the success of small businesses. Topics include expense management, shipping and delivery, online business, and marketing solutions. Learn more here.

Insight 3: Take Out Is Here To Stay

In McKinsey’s survey about COVID-19 dining habits, 32% of participants said they had used restaurant delivery, and of those, 43% plan to continue to use it. 34% said they used restaurant curbside pickup, and of those, 43% plan to continue to use it. 75% of respondents said they are somewhat worried or worried about dining in at a restaurant or bar in the next two weeks.

One of the main consumer behavior changes that McKinsey believes will continue past the pandemic is the willingness of consumers to try new shopping methods, like using new technology or apps. They found that over 75% of Americans have tried “either new brands, places to shop, or shopping methods during the crisis.” Of those consumers, most “intend to continue using a combination of what they did before COVID-19 and what they tried during the crisis.”

Another factor that will increasingly drive diners to delivery or takeout is changing weather. Internal Resy data shows bad weather has a huge impact on daily cover counts. When Hurricane Isaias barreled up the East Coast in early August, we saw double-digit drops in cover count percentages from comparable days in many cities. As summer comes to a close and the weather continues to grow more unfavorable to outdoor dining, at-home dining options will continue to be popular among consumers.

How Resy Helps: Resy At Home for Take Home Experiences, Large Format Meals, and Virtual Events

- Resy At Home: We created Resy At Home so you can create, curate, and feed your diners’ love of restaurants at home and generate new streams of revenue for your restaurant. You can use the tools in Resy At Home to offer unique pick-up options like large format meals, grocery boxes, or meal kits. The Events tool allows you to host and manage virtual events like cooking classes, wine tastings, happy hours, and curated discussions.

*Opinions and views in articles shared on Resy OS are presented for the purpose of discussion and commentary on topics of interest in the restaurant industry; they should not be viewed as substitutes for advice given by professionally engaged business consultants and advisors.

Discover More